lake county real estate taxes illinois

Ad Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More. At Lake County Appeal we possess the knowledge capital to win even the most challenging appeals.

No warranties expressed or implied are.

. Ad Valorem Taxes. Select Tax Year on the right. The median property tax also known as real estate tax in Lake County is 628500 per year based on a median home value of 28730000 and a median effective property tax rate of.

The median property tax in Lake County Illinois is 6285 per year for a home worth the median value of 287300. Any changes to the tax roll name address location assessed value must be processed through the Lake County Property Appraisers Office 352 253-2150. Ad Avalara makes it easier to apply the right rental sales tax on your customer bookings.

Select Home Page Menu Image. The extension titled the COVID-19 Tax. The exact property tax levied depends on the county in Illinois the property is located in.

Select Tax Year on. Our team knows Lake County and Chicagoland as a whole. In response to COVID-19 the Lake County Clerks Tax Extension and Redemption Department is open on weekdays as follows.

Search Lake County Records Online - Results In Minutes. Lake County Appeal has. County Treasurer GENERAL.

Ad Avalara makes it easier to apply the right rental sales tax on your customer bookings. Lake County IL Property Tax Information. 2021 Taxes Payable in 2022.

At more than double. Search For Title Tax Pre-Foreclosure Info Today. Calculate state and local sales and lodging taxes even for out of state properties.

Lake County collects the highest property tax in Illinois levying an average of 628500 219 of. Calculate state and local sales and lodging taxes even for out of state properties. The average household in Lake County last year paid 268 of the value of their single-family home in property taxes according to ATTOM Data Solutions.

Be Your Own Property Detective. Lake County collects on average 219 of a propertys assessed fair. 9 AM to 430 PM.

Ad Find Information On Any Lake County Property. The Lake County Property Records and Licensing Office make every effort to maintain the most accurate information possible. Daley voted to give Chicago and Cook County property owners a 60-day extension on payment of the 2020 real estate taxes because of the pandemic.

2021 Taxes Payable in 2022. Site Appearance Format Images.

North Central Illinois Economic Development Corporation Property Taxes

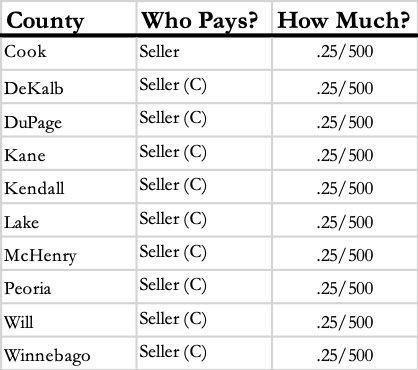

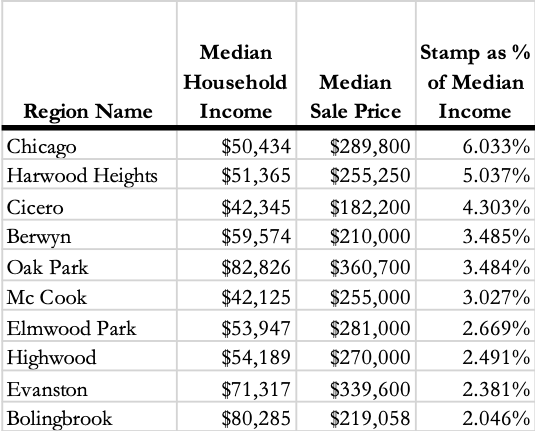

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

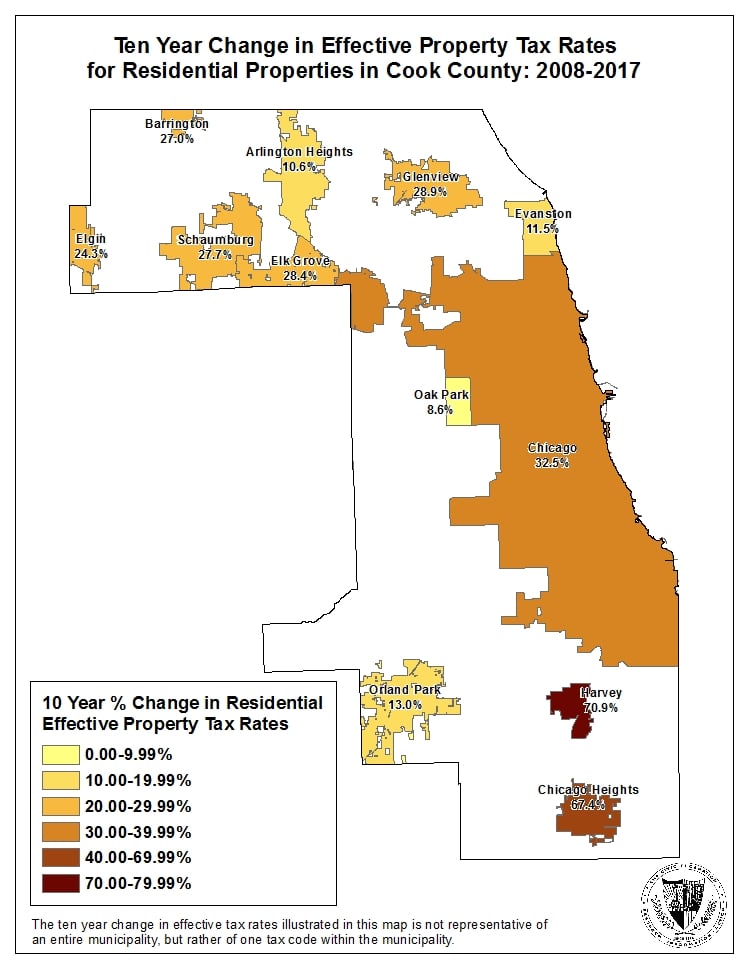

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Homes For Sale Real Estate For Rent

Township Assessors Get 3 000 Bonus For Doing Job Right

Covid 19 Faq Cook County Assessor S Office

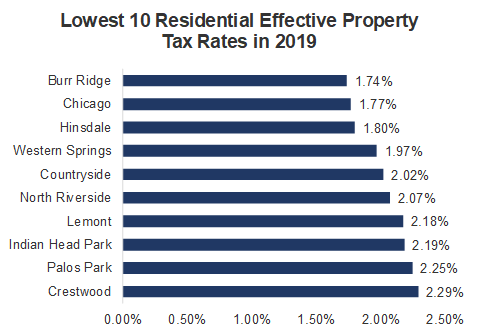

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Citrus Springs Fl Property For Sale 373 W Homeway Loop

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Property Tax City Of Decatur Il

Taxing The Poor Through Real Estate Transfers University Of Illinois Law Review

The First Installment Of Property Tax Bills Is Due June 6

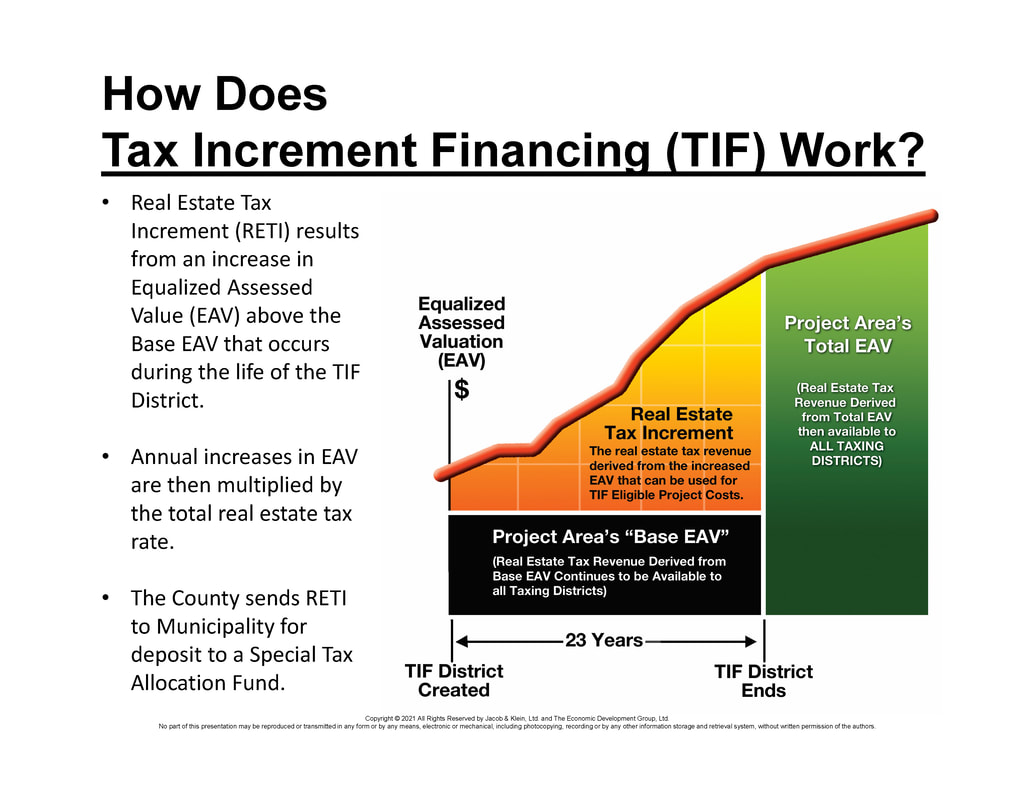

What Is Tax Increment Financing

What Is The Right Tax Proration Amount In Chicago Closings Chicago Real Estate Closing Blog

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation